-

Downbeat mood spreads from Asia as U.S.-China frictions build

-

OPEC will debate whether to raise oil output in Vienna Friday

European stocks edged lower following drops for U.S. futures and Asian peers as concerns grew over the escalating protectionist standoff between China and the U.S. Oil fell before a key OPEC meeting this week, while the dollar gained and Treasuries were steady.

Energy shares led the slide as the Stoxx Europe 600 Index opened in the red, while S&P 500 Index futures pointed to U.S. equities extending Friday’s decline. In Asia, markets were closed for the holidays in China and Hong Kong — where they are more sensitive to deepening trade tensions. Japan’s Topix Index fell the most in almost three weeks as the yen edged higher and after a strong earthquake hit Osaka, one of Japan’s industrial heartlands. Oil extended a decline as Saudi Arabia and Russia prepared for a clash with other OPEC members and allies over whether to raise production.

“Up to now it’s been hypothetical; action has been taken, tariffs are coming and you need to pay very, very careful attention to the impact it’s going to have on your holdings,” Bank of Singapore Chief Investment Officer Johan Jooste told Bloomberg Television. “There are too many unknowns right now to be terribly specific. The thing you do know is risk is higher. The market will take something of a cautionary stance.”

Elsewhere, the euro was under pressure as a migration policy crisis threatens German Chancellor Angela Merkel’s coalition. The pound ticked lower ahead of a parliament debate on the Brexit withdrawal bill.

Terminal users can read more in Bloomberg’s Markets Live blog.

Here are some key events to watch for this week:

- On Monday, the U.K. House of Lords takes up the Brexit withdrawal bill after dramatic votes in the Commons, with details likely to emerge on the amendment that quelled a revolt by pro-EU Conservatives.

- European Central Bank President Mario Draghi speaks at ECB’s Forum on Central Banking on Tuesday.

- U.S. housing starts probably rose in May, data out Tuesday is expected to show.

- Draghi, Reserve Bank of Australia Governor Philip Lowe, Bank of Japan Governor Haruhiko Kuroda, and Fed Chairman Jerome Powell join a panel on central bank policy in Sintra, Portugal, on Wednesday.

- Thailand, Philippines and Brazil central bank decisions due Wednesday.

- Bank of England rate decision on Thursday.

- Also on Thursday: U.S. jobless claims, New Zealand GDP, South Korea export data.

- The Organization of Petroleum Exporting Countries meets in Vienna on Friday.

And here are the main market moves:

Stocks

- The Stoxx Europe 600 Index decreased 0.2 percent as of 8:04 a.m. London time.

- The MSCI World Index of developed countries dipped 0.2 percent to the lowest in almost two weeks.

- The MSCI Asia Pacific Index dipped 0.7 percent to the lowest in almost three weeks.

- Japan’s Nikkei 225 Stock Average declined 0.8 percent to the lowest in more than a week.

- The MSCI Emerging Market Index declined 0.4 percent to the lowest in more than six months.

- The U.K.’s FTSE 100 Index rose 0.1 percent.

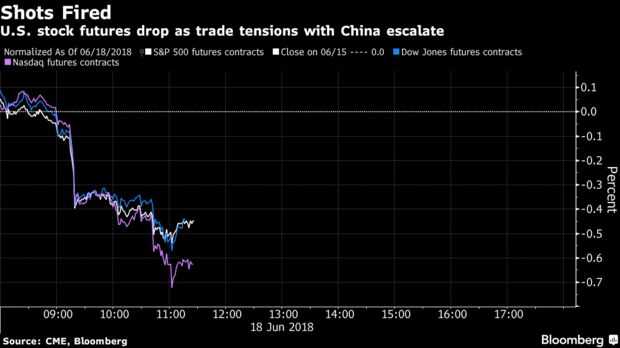

- Futures on the S&P 500 Index dipped 0.4 percent to the lowest in almost two weeks on the largest decrease in more than two weeks.

Currencies

- The Bloomberg Dollar Spot Index climbed 0.1 percent to the highest in more than 11 months.

- The euro declined 0.3 percent to $1.1578.

- The British pound dipped 0.2 percent to $1.3245, the weakest in seven months.

- The Japanese yen gained 0.1 percent to 110.57 per dollar, the largest rise in more than a week.

Bonds

- The yield on 10-year Treasuries decreased less than one basis point to 2.92 percent, the lowest in more than two weeks.

- Germany’s 10-year yield was unchanged at 0.40 percent, the lowest in almost two weeks.

- Britain’s 10-year yield dipped one basis point to 1.328 percent, reaching the lowest in almost two weeks on its fifth straight decline.

Commodities

- West Texas Intermediate crude decreased 1.5 percent to $64.07 a barrel, the lowest in 10 weeks.

- Gold fell 0.1 percent to $1,278.89 an ounce, the weakest in about six months.

By Andreea Papuc and Samuel Potter

June 18, 2018, 5:15 PM GMT+10

Source: Bloomberg