-

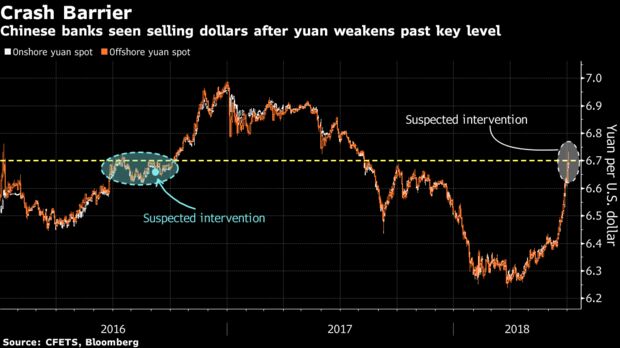

China closely watching recent FX fluctuation: PBOC statement

-

WTI oil rallies fifth day in six as Saudi fails to move needle

Stock markets showed signs of stabilizing on Tuesday, with European shares and U.S. futures rising following a mixed Asian session in which all eyes were on the yuan. The euro strengthened as Germany’s coalition government dodged a crisis over migration.

That helped the yuan erase earlier losses and developing-nation currencies overall edge higher, though Turkey’s lira plunged after inflation data. The dollar fell versus major peers while Treasuries were steady, and the Swedish krona advanced as the country’s central bank stuck to its plan tostart lifting interest rates.

While the global trade spat between the worlds biggest economies appears to be worsening — President Donald Trump is taking measures to preventChina Mobile Ltd. from entering the U.S. market — investors will take some cheer from the PBOC’s pledge to keep the yuan stable. They’ll also be looking to minutes from the Federal Reserve and jobs data later in the week to provide a welcome distraction from protectionist risks after the country celebrates its independence day.

Elsewhere, West Texas intermediate crude climbed for the fifth time in six sessions as a Saudi Arabian production increase failed to move the needle on global supply. Metals recovered after losses which saw platinum drop to the lowest in nine years.

Terminal users can read more in Bloomberg’s Markets Live blog.

These are key events coming up this week:

- The U.S. celebrates Independence Day on Wednesday, July 4. Stock and bond markets are closed, along with government offices.

- Federal Reserve releases minutes of its June 12-13 meeting, when FOMC policy makers raised the benchmark rate a quarter point for the second time this year and lifted the median forecast to four total increases in 2018.

- U.S. payrolls are due Friday.

- Also on Friday, the U.S. is scheduled to impose tariffs on $34 billion of Chinese goods. Beijing has said it will slap tariffs on an equal value on U.S. exports including agricultural and auto exports.

Here are the main market moves:

Stocks

- The Stoxx Europe 600 Index increased 0.4 percent as of 9:19 a.m. London time.

- Futures on the S&P 500 Index advanced 0.2 percent to the highest in more than a week.

- The MSCI All-Country World Index gained 0.2 percent.

- The MSCI Emerging Market Index decreased 0.3 percent.

Currencies

- The Bloomberg Dollar Spot Index dipped 0.4 percent.

- The euro advanced 0.3 percent to $1.1673.

- The British pound climbed 0.4 percent to $1.3196.

- The offshore yuan gained less than 0.05 percent to 6.6744 per dollar, the biggest rise in almost three weeks.

Bonds

- The yield on 10-year Treasuries advanced one basis point to 2.88 percent, the highest in more than a week.

- Germany’s 10-year yield gained three basis points to 0.33 percent, the highest in a week on the largest climb in more than three weeks.

- Britain’s 10-year yield gained two basis points to 1.275 percent, the highest in a week on the biggest gain in more than a week.

Commodities

- The Bloomberg Commodity Index climbed 0.4 percent.

- West Texas Intermediate crude increased 0.9 percent to $74.62 a barrel, the highest in more than three years.

- LME copper climbed 0.8 percent to $6,578.00 per metric ton, the biggest increase in almost four weeks.

- Gold gained 0.3 percent to $1,245.48 an ounce.

By Eddie van der Walt and Adam Haigh

July 3, 2018, 6:32 PM GMT+10

— With assistance by Sarah Ponczek, and Richard Frost

Source: Bloomberg