-

Europe shares, U.S. futures climb on Powell comments, minutes

-

Crude oil adds to Wednesday surge; emerging-market shares jump

European equities climbed alongside U.S. futures and Asian stocks as investors cheered fresh signs from central bankers that rates are headed lower. Treasuries rose and the dollar fell.

The Stoxx Europe 600 Index advanced, with energy companies leading the way as crude oil prices surged. U.S. futures climbed after the S&P 500 briefly topped 3,000 for the first time Wednesday as Federal Reserve Chairman Jerome Powell signaled a willingness to lower rates, citing a slowing global economy and trade issues. Shares rose across most of Asia with the South Korean and Hong Kong markets outperforming, though stocks in China pared gains as the session progressed. The yield on 10-year Treasuries slipped to 2.05%.

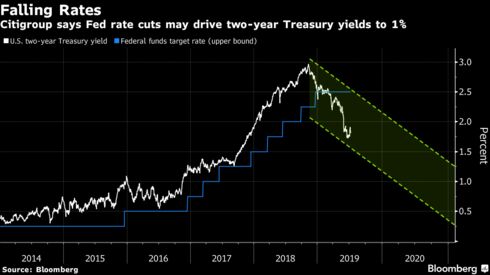

This year’s rallies across stocks, bonds and credit got a fresh jolt on Wednesday thanks to comments from Fed Chairman Powell that persuaded investors rates are headed lower by at least a quarter-point in July. Minutes from the central bank’s last meeting further cemented expectations for a cut in borrowing costs.

Elswehere, emerging-market stocks and currencies climbed. Oil extended gains after closing at a seven-week high ahead of a potential hurricane in the Gulf of Mexico.

Here are some key events coming up:

- Powell testifies to Senate Banking Committee on Thursday.

- ECB minutes are due on Thursday.

- A key measure of U.S. inflation — the core consumer price index, due Thursday — is expected to have increased 0.2% in June from the prior month, while the broader CPI is forecast to remain unchanged.

- U.S. producer prices are due on Friday.

Here are the main moves in markets:

Stocks

- Futures on the S&P 500 Index rose 0.2% as of 8:25 a.m. London time to the highest on record.

- The S&P 500 Index rose 0.5% to the highest in more than a week.

- Germany’s DAX Index rose 0.2%, the first advance in a week.

- The U.K.’s FTSE 100 Index increased 0.3%, the first advance in more than a week.

- The MSCI Emerging Market Index jumped 0.7%, the largest climb in more than a week.

- The MSCI Asia Pacific Index jumped 0.7%, the biggest increase in more than a week.

Currencies

- The Bloomberg Dollar Spot Index decreased 0.2%.

- The euro rose 0.2% to $1.1269, the strongest in a week.

- The British pound increased 0.2% to $1.2531, the strongest in a week.

- The Japanese yen gained 0.4% to 108.08 per dollar, the strongest in a week.

Bonds

- The yield on 10-year Treasuries declined one basis point to 2.05%, the largest fall in more than a week.

- Germany’s 10-year yield increased four basis points to -0.26%, the highest in more than three weeks.

- Britain’s 10-year yield fell less than one basis point to 0.755%.

Commodities

- West Texas Intermediate crude climbed 0.4% to $60.65 a barrel, reaching the highest in seven weeks.

- Gold rose 0.2% to $1,421.95 an ounce, the highest in more than two weeks.

- Iron ore dipped 1.1% to $113.35 per metric ton.

By

— With assistance by Ruth Carson, and Kam Sau Yung

11 July 2019, 17:33 GMT+10

Source: Bloomberg