-

Trump threatens to jack up China tariffs this coming Friday

-

Tweets risk upending months of progress in bilateral talks

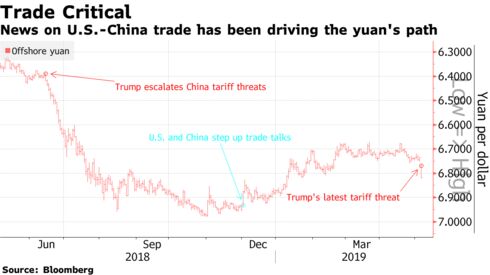

Equities tumbled and the yuan plunged after President Donald Trump’s threat to increase tariffs on Chinese imports called into question whether a would-be-final-round of trade talks will take place this week.

Treasury futures climbed and oil sank following Trump’s plan to hike tariffs on Friday and news that China is considering delaying the upcoming talks. Chinese stocks were hit especially hard, with benchmark indexes tumbling about 6 percent. The government even called on its “National Team” of state investors to prepare to stabilize the market if needed on Monday, according to people familiar with the matter. The yen rose and the Aussie slid. Futures on the S&P 500 Index sank as much as 2.2 percent, signaling a nasty start to the week on Wall Street. European futures also retreated.

Trump ramped up pressure on China to make concessions by threatening to more than double tariffs on $200 billion of Chinese goods, and impose a fresh round of duties on top of that. Chinese Vice-Premier Liu He was scheduled to arrive in Washington Wednesday with a delegation of about 100, but now China is considering delaying that trip, according to people familiar with the matter. The South China Morning Post said a cancellation is also possible.

“It’s making the outcomes more binary, with everybody focused on the Friday deadline — there doesn’t seem to be much leeway now to much go past that,” Joyce Chang, chair of global research at JPMorgan Chase & Co., said on Bloomberg Television. “It’s going to mean that investors will be very focused on the trade issues even beyond China,” with a review of U.S. auto-import tariffs still pending, she said.

Adding to the mix, North Korea carried out a weapons test, that potentially included its first ballistic missile launch since 2017, challenging Trump’s bottom line in nuclear talks. Meantime, West Texas Intermediate crude declined as much as 3 percent. Saudi Arabia cut June pricing for all crude grades to the U.S. in a move that appeared to be aimed at easing concern over supplies.

Trump’s comments came after the S&P 500 Index rose the most in a month Friday, with April employment data suggesting the American labor market can support growth without sparking inflation. U.S. Treasury futures soared, with the cash market closed due to a holiday in Japan.

Here are some notable events coming up:

- Chinese Vice Premier Liu He is scheduled to return to Washington for trade talks on Wednesday, though the schedule may now be in flux.

- The Reserve Bank of Australia meets to set interest rates Tuesday, while New Zealand central bank does the same the following day.

- China releases trade data Wednesday, and the U.S. does so on Thursday.

- South Africa holds national elections Wednesday.

- European Union leaders gather Thursday to discuss policy priorities for the coming five years.

- China reports on inflation Thursday. The U.S. releases the April CPI report Friday.

- South Korea’s markets are closed Monday for a holiday.

These are the main moves in markets:

Stocks

- Futures on the S&P 500 Index slid 1.6 percent as of 1:44 p.m. in Hong Kong.

- China’s CSI 300 Index tumbled 5.9 percent, heading for the biggest daily drop since February 2016

- Hong Kong’s Hang Seng Index declined 3 percent.

- Australia’s S&P/ASX 200 Index dropped 0.9 percent.

- Euro Stoxx 50 futures fell 1.4 percent.

- Contracts on the Nikkei 225 Stock Average fell 1.8 percent in Chicago.

Currencies

- The yen rose 0.3 percent to 110.80 per dollar.

- The offshore yuan traded at 6.7960 per dollar, down 0.9 percent.

- The Bloomberg Dollar Spot Index rose 0.3 percent.

- The euro slipped 0.1 percent to $1.1188.

- Britain’s pound fell 0.4 percent to $1.3122

- The Aussie fell 0.5 percent to 69.86 U.S. cents.

Bonds

- Futures on 10-year Treasuries soared 16/32 to 123-27. Yields were at 2.53 percent at last week’s close in the cash market.

- Australian 10-year government bond yields dropped about 5 basis points, to 1.74 percent.

Commodities

- West Texas Intermediate crude fell 2.3 percent to $60.51 a barrel.

- Gold added 0.3 percent to $1,282.47 an ounce.

By Andreea Papuc – 6 May 2019, 15:51 GMT+10

Source: Bloomberg