US Dollar Index Speculator Positions

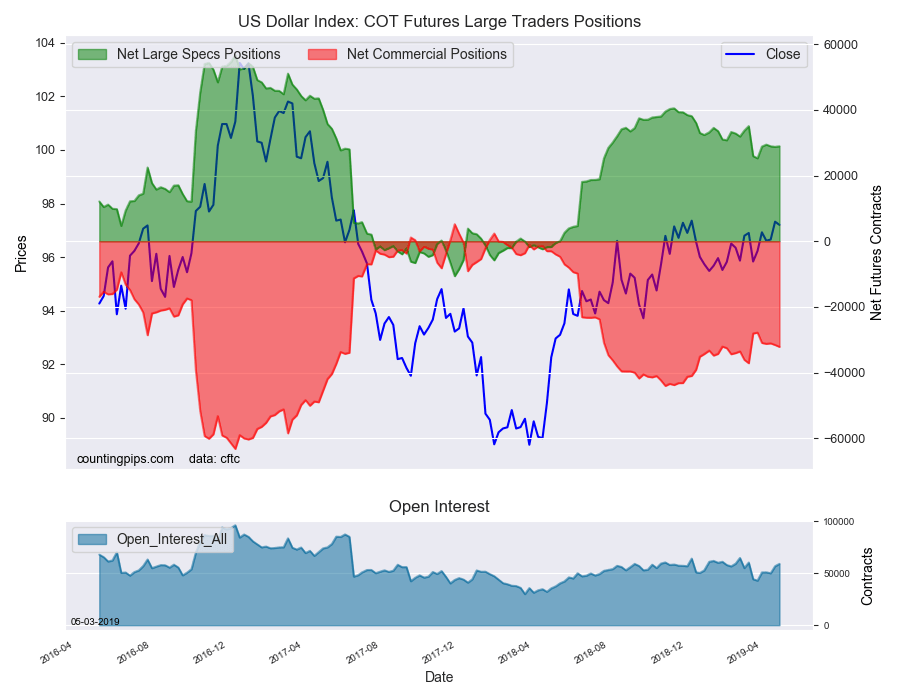

Large currency speculators added to their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 28,949 contracts in the data reported through Tuesday April 30th. This was a weekly gain of 194 contracts from the previous week which had a total of 28,755 net contracts.

This week’s net position was the result of the gross bullish position gaining by 2,040 contracts to a weekly total of 51,212 contracts and outnumbered the gross bearish position total of 22,263 contracts that increased by 1,846 contracts for the week.

The net speculative position edged a bit higher this week after having declined in the previous two weeks. The current speculator sentiment remains firmly bullish although the overall position has now been under the +30,000 net contract level for seven consecutive weeks. Previously, the net positioning had stayed above this threshold for thirty-two straight weeks through March 12th.

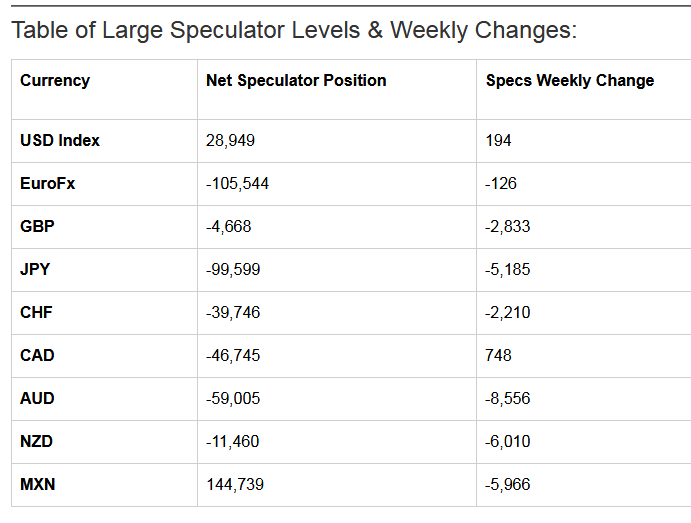

Individual Currencies Data this week:

The individual contracts data, showed that the major currencies with improving speculator positions this week were the US dollar index (194 weekly change in contracts) and the Canadian dollar (748 contracts).

The currencies whose speculative bets declined this week were the euro (-126 weekly change in contracts), British pound sterling (-2,833 contracts), Japanese yen (-5,185 contracts), Swiss franc (-2,210 contracts), Australian dollar (-8,556 contracts), New Zealand dollar (-6,010 contracts) and the Mexican peso (-5,966 contracts).

Notables for the week:

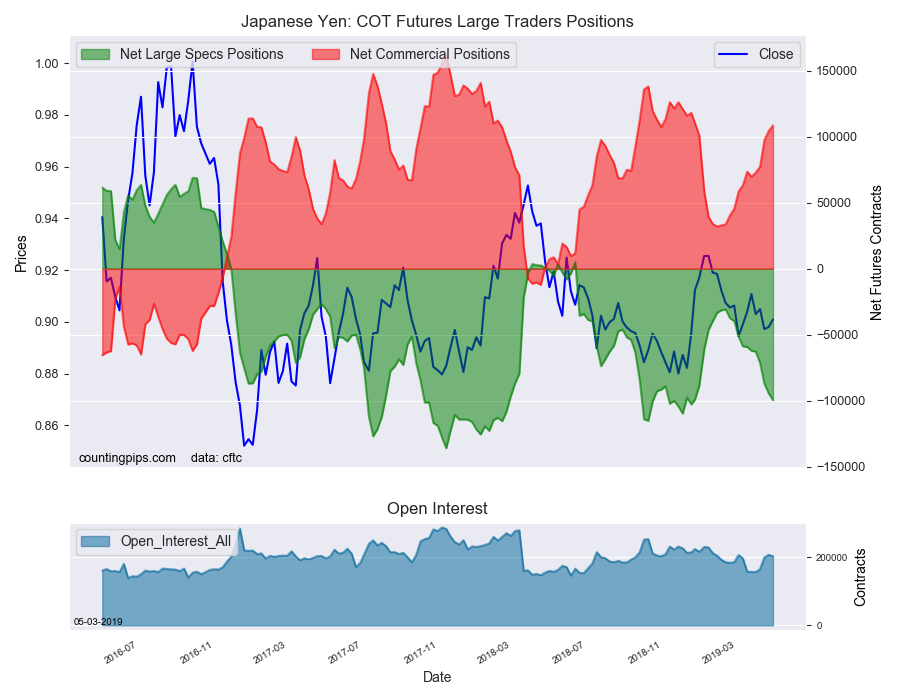

Japanese yen bearish bets rose for the eleventh straight week and by a total of -68,857 contracts over that period. The yen position is now at the most bearish level since December 18th when the net position was -102,771 contracts. Yen positions have remained in bearish territory for forty-two straight weeks dating back to June 12th of 2018.

Euro positions continued to see higher bearish levels this week as well. Euro bets have had rising bearish positions for two straight weeks and for six times out of the past seven weeks. The overall bearish position is above the -105,000 contract level for a second straight week and is at the highest bearish level since December 6th of 2016.

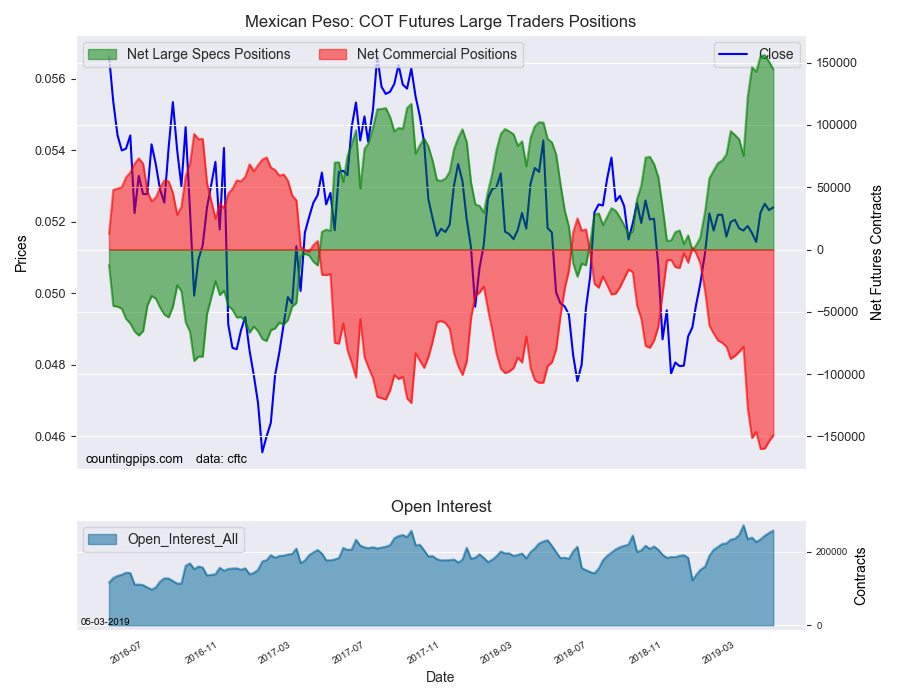

Mexican peso positions have cooled off for two weeks in a row after rising to an all-time record high bullish position on April 16th. The peso remains the only other major currency besides the USD Index with positive speculator bets.

See the table and individual currency charts below.

Weekly Charts: Large Trader Weekly Positions vs Price

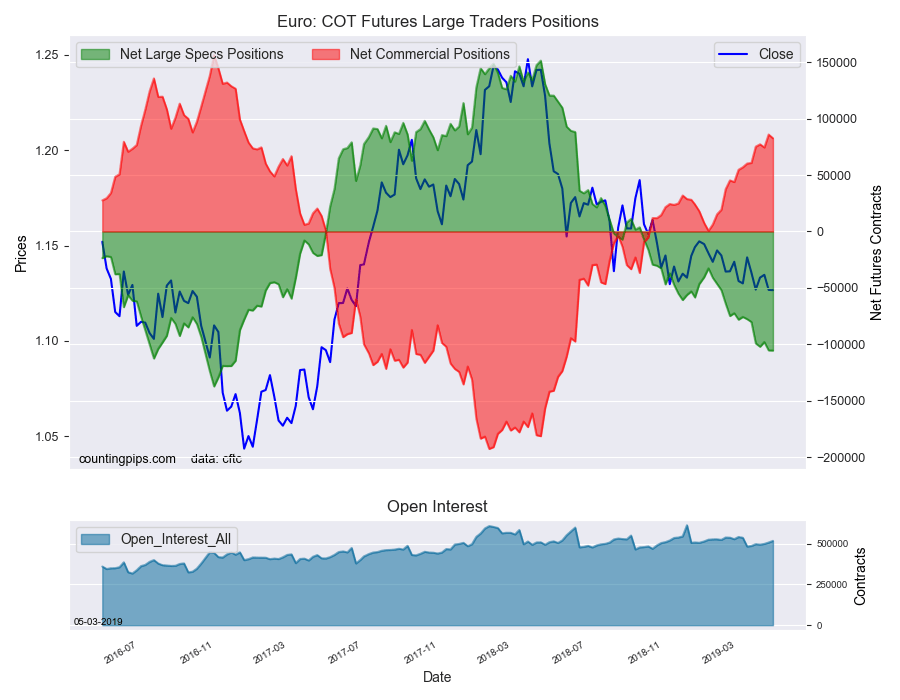

EuroFX:

The Euro large speculator standing this week equaled a net position of -105,544 contracts in the data reported through Tuesday. This was a weekly fall of -126 contracts from the previous week which had a total of -105,418 net contracts.

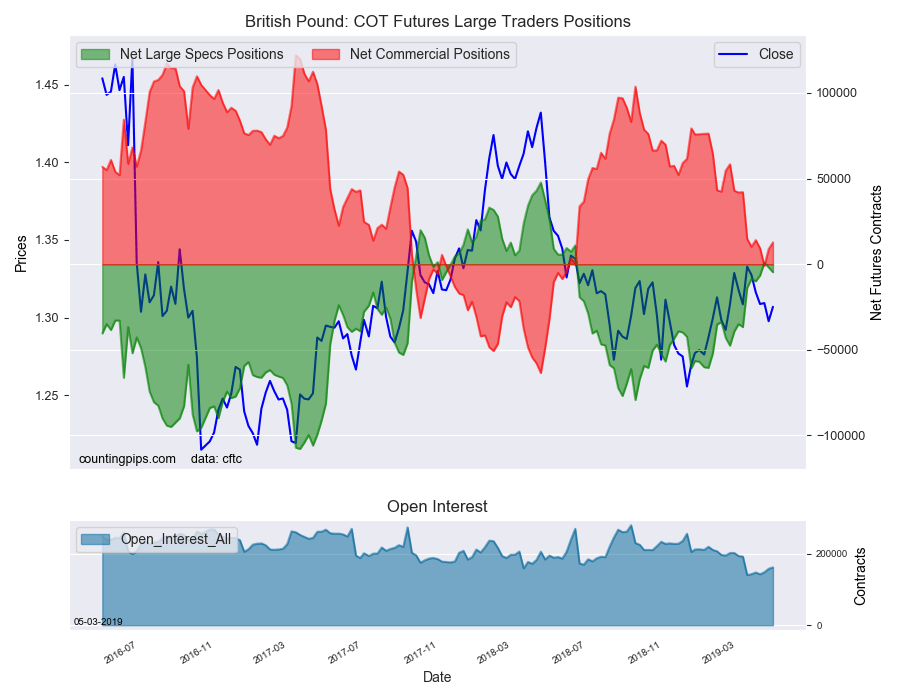

British Pound Sterling:

The large British pound sterling speculator level recorded a net position of -4,668 contracts in the data reported this week. This was a weekly decline of -2,833 contracts from the previous week which had a total of -1,835 net contracts.

Japanese Yen:

Large Japanese yen speculators reached a net position of -99,599 contracts in this week’s data. This was a weekly reduction of -5,185 contracts from the previous week which had a total of -94,414 net contracts.

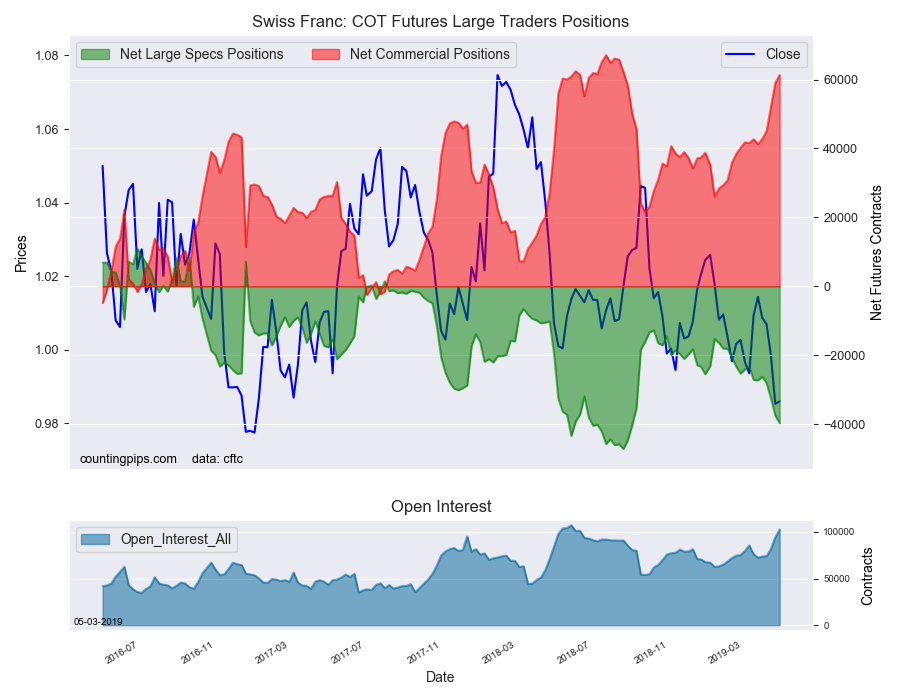

Swiss Franc:

The Swiss franc speculator standing this week totaled a net position of -39,746 contracts in the data through Tuesday. This was a weekly decline of -2,210 contracts from the previous week which had a total of -37,536 net contracts.

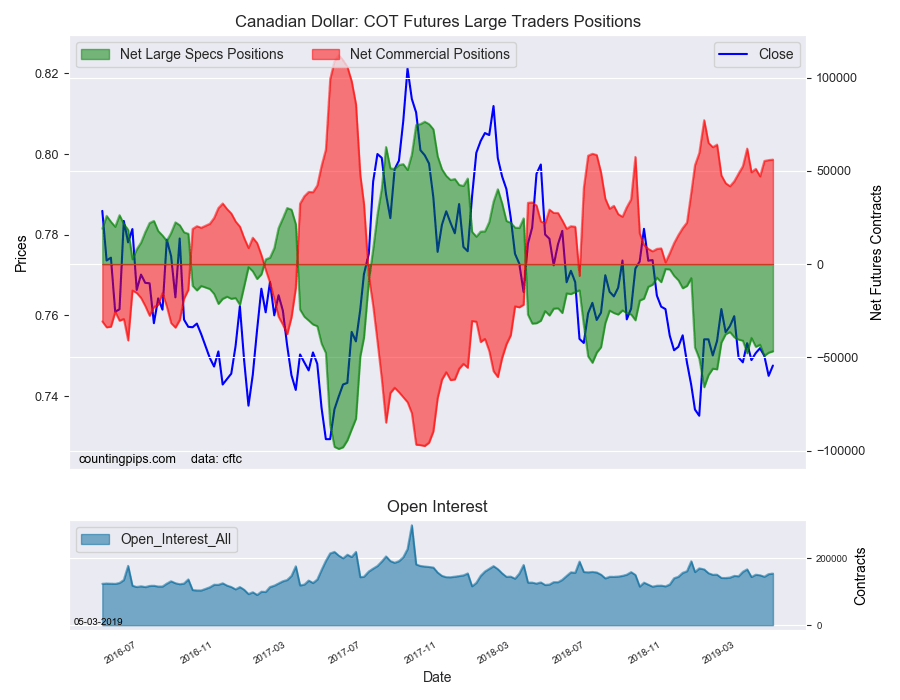

Canadian Dollar:

Canadian dollar speculators totaled a net position of -46,745 contracts this week. This was a lift of 748 contracts from the previous week which had a total of -47,493 net contracts.

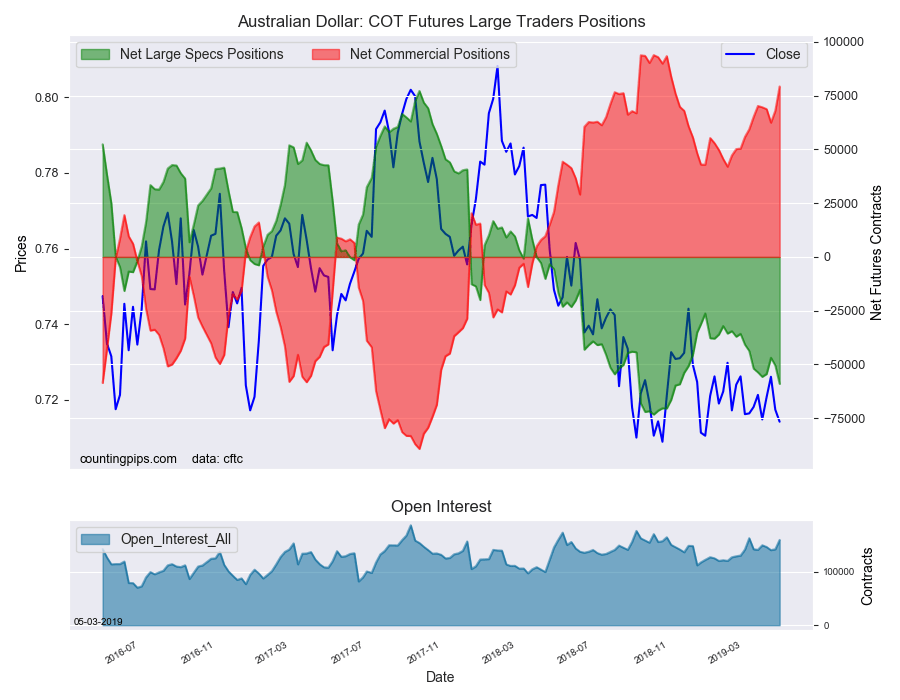

Australian Dollar:

The large speculator positions in Australian dollar futures reached a net position of -59,005 contracts this week in the data ending Tuesday. This was a weekly decrease of -8,556 contracts from the previous week which had a total of -50,449 net contracts.

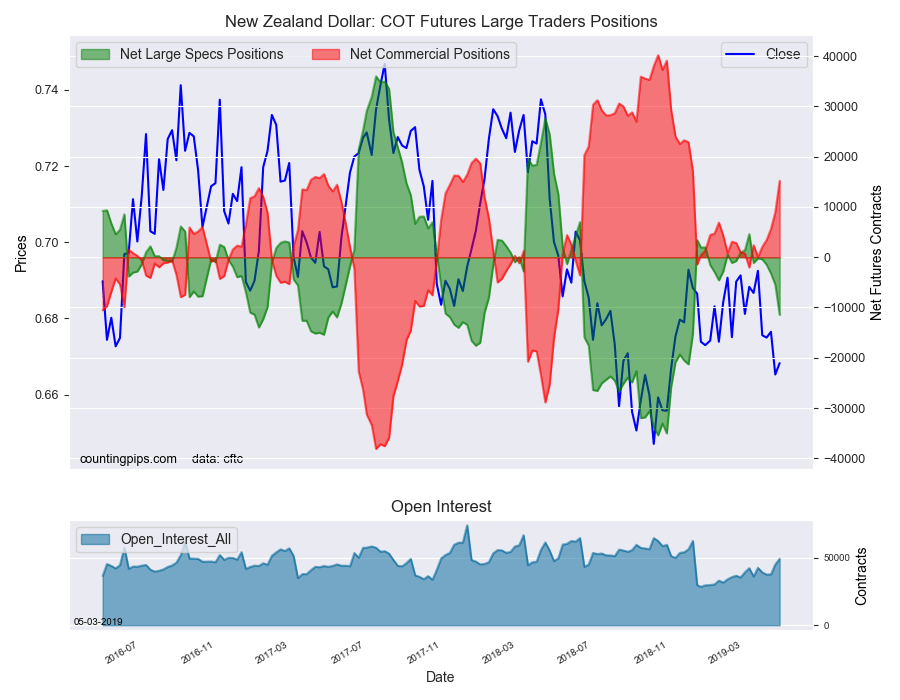

New Zealand Dollar:

The New Zealand dollar speculative standing was a net position of -11,460 contracts this week in the latest COT data. This was a weekly lowering of -6,010 contracts from the previous week which had a total of -5,450 net contracts.

Mexican Peso:

Mexican peso speculators equaled a net position of 144,739 contracts this week. This was a weekly fall of -5,966 contracts from the previous week which had a total of 150,705 net contracts.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

By Zachary Storella – May 05, 2019

By Zachary Storella – May 05, 2019

Source: Investing.com