-

Asia shares slump following S&P 500 drop; euro gains on data

-

10-year Treasury yield holds at 2.46%; WTI oil edges higher

U.S. equity-index futures and European stocks were steady on Wednesday, shrugging off declines across Asia as markets showed signs of stabilizing following this week’s trade-fear driven selloff. The euro gained after upbeat German factory data.

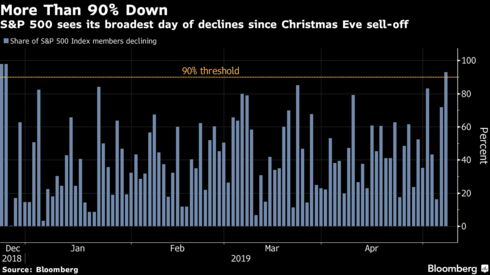

An unexpected escalation of President Donald Trump’s rhetoric on trade in the past few days has caught global equity markets, many of which had been testing record highs, off guard and triggered a steep pullback. Investor focus now turns to Washington and the visit of China’s top trade negotiator to continue talks toward a deal.

“The two largest economic powerhouses, the U.S. and China, either will be at a trade war or a trade peace and in reality there’s only a couple of people who know the answer to that and it isn’t those of us on Wall Street,” Larry Robbins, Glenview Capital Management’s CEO, told Bloomberg TV in New York. “It’s to be expected that there’s some volatility into this critical week.”

Elsewhere, China exports unexpectedly fell in April, data showed Wednesday, and imports rose. The New Zealand dollar pared a slump of more than 1 percent as the central bank cut interest rates to a record and signaled the chance of one further reduction amid slowing global growth and weak inflation. That makes the RBNZ the first central bank in the developed world to begin loosening policy this cycle.

The lira extended losses against the dollar amid the fallout from Turkey’s decision to re-run municipal elections in Istanbul. Oil recovered after dropping toward $60 a barrel.

Here are some notable events coming up:

- The U.S. releases trade data Thursday.

- South Africa holds national elections Wednesday.

- China reports on inflation Thursday. The U.S. releases the April CPI report Friday.

- A Chinese trade delegation is expected to arrive in Washington for talks.

These are the main moves in markets:

Stocks

- Futures on the S&P 500 Index gained 0.1 percent as of 8:09 a.m. London time.

- The Stoxx Europe 600 Index dipped less than 0.05 percent.

- The U.K.’s FTSE 100 Index fell 0.1 percent to the lowest in almost six weeks.

- The MSCI Asia Pacific Index sank 1 percent to the lowest in almost six weeks.

- The MSCI Emerging Market Index decreased 0.5 percent to the lowest in almost six weeks.

Currencies

- The Bloomberg Dollar Spot Index dipped less than 0.05 percent.

- The euro gained 0.1 percent to $1.1205, the strongest in more than a week.

- The British pound decreased 0.2 percent to $1.3052.

- The Japanese yen rose 0.1 percent to 110.11 per dollar, the strongest in more than six weeks.

Bonds

- The yield on 10-year Treasuries gained less than one basis point to 2.46 percent.

- Germany’s 10-year yield increased less than one basis point to -0.04 percent.

- Britain’s 10-year yield fell one basis point to 1.147 percent, the lowest in more than a week.

Commodities

- Gold increased 0.3 percent to $1,287.95 an ounce, the highest in almost four weeks.

- West Texas Intermediate crude rose 1 percent to $62.03 a barrel, the biggest advance in more than two weeks.

By Adam Haigh and Samuel Potter

8 May 2019, 17:16 GMT+10

Source: Bloomberg