Stock markets are shrugging off yesterday’s weaker private NFP jobs and today’s Trade Balance data and are instead cheering some good corporate results, upbeat weekly employment data and the stabilising Oil price. The USD isn’t sharing this joy though and has dipped, I suspect, on the weaker jobs and Trade Balance data.

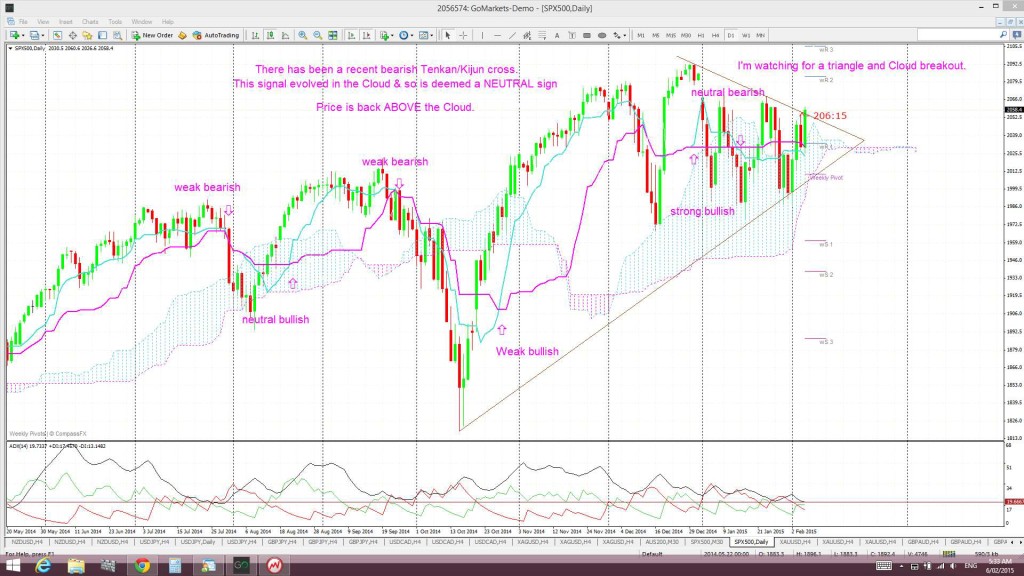

S&P500 daily: the markets are yet to close BUT the S&P500 is attempting a triangle breakout and is back above the daily Cloud. Any new Tenkan/Kijun cross here would most likely be a ‘strong’ BUY signal:

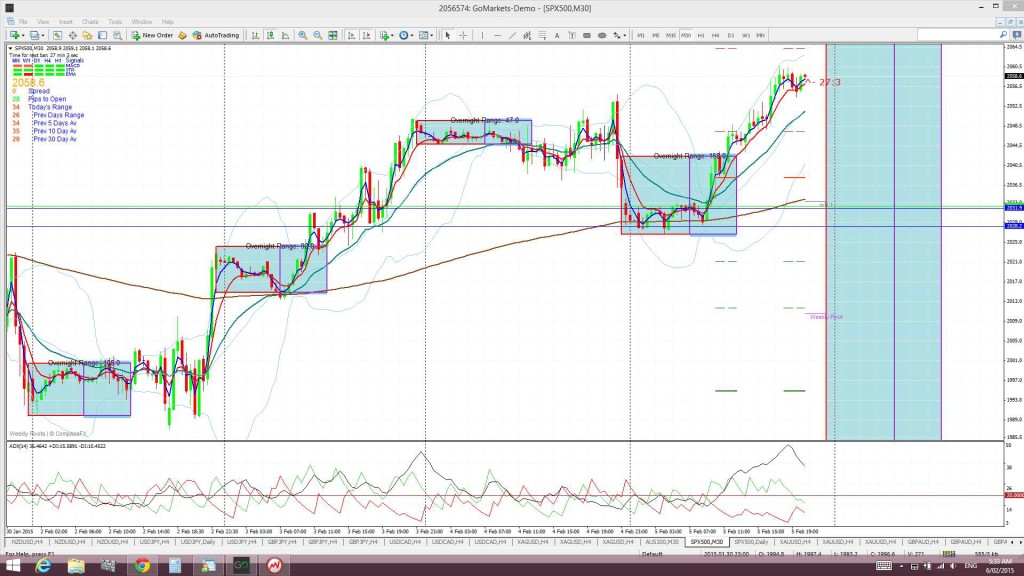

S&P500 30 min: again, the 30 min chart offered good risk/reward trading here!

Australian ASX-200: I noted a bullish triangle breakout here back on Jan 27th. This index has rallied almost 5% since then (5541.1 to 5811.0) and I suspect it is headed to test the 78.6% fib near 6,000. After that, 7,000!

Gold: is holding above $1,250 but the preference for yield potential stocks isn’t compensating the dip in the USD here:

TC Signals: the Cable TC signal is now up 160 pips. As luck would have it, I took the other two losers and left this one!

GBP/JPY: GBP news got the GBP/JPY pair moving too and a new TC signal came off my 1 am candle:

Other FX: Traders need to be careful with today’s NFP as this data could swing USD sentiment either way and trying to pick the direction now, before the event, is really gambling! I am still thinking though that we could be getting closer to the start of a possible ‘risk on’ rally: lower USD, higher stocks, higher E/U, A/U, Kiwi etc.

E/U and E/J: both of these pairs gave TC signals two days ago that failed BUT both pairs are trading higher again and trying to form new TC signals. Now, this is a pattern I have seen before when a currency pair is trying to grind out either a base or a top. Thus, I wouldn’t be surprised if the next TC signals, should they evolve, run better than the previous ones! NFP could swing USD sentiment either way so I will wait until after this data is out before chasing any new signals.

E/U: trying for another go at running higher!

E/J: ditto here:

A/U: I tweeted yesterday that this was starting to look like a bullish ‘inverse H&S’ on the 4hr chart. I see the ‘neck line’ at 0.785. It has also broken up through the Bear trend line BUT the 4hr Cloud is in its way. The weaker USD, stabilising Oil price and supported Gold would be helping lift the A/U:

A/J: much the same here. Price is testing a Bear trend line but facing the 4hr Cloud. There is an ‘inverse H&S look here too!

Kiwi: the weaker USD is helping to support this pair above the key 0.735 level. Price is in the 4hr Cloud at the moment;

U/J: this is higher with stocks despite the weaker USD. Price is still stuck in the daily Cloud. Watch for any breakout here though:

Loonie: this is lower with the weaker USD and boost to the CAD from stabilising Oil. There is a new TC signal trying to form but price is still in the 4hr Cloud although close to emerging. Also, price is within a 4hr triangle so I’ll watch for any Cloud and triangle breakdown to support any new TC signal:

EUR/GBP: choppy as both the EUR and GBP strengthen. Price is still below the key 0.77 level:

The post USD nervous ahead of NFP, stocks rally & S&P500 trying for a breakout. appeared first on www.forextell.com.