Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

AUDUSD: Aud higher on China RRR cut. RBA Stevens’ speech, tonight, RBA Minutes (Tue), CPI (Wed) by FX Charts Daily

AUD/USD: 0.7815 China has surprised the market with a weekend cut to the RRR of 1% and an extra 0.5%-2.0% of RRR cuts for several qualified financial institutions. The size of the cut is much larger than economists had been expecting and will raise concerns about the growth outlook although the Aud$ likes the idea and has […]

GBPUSD: Cable volatility to continue leading into the Election (May 7) by FX Charts Daily

GBP/USD: 1.4958 Cable had a choppy Friday session in finally taking out the resistance in the 1.4970/1.5000 area, triggering stops to squeeze up to 1.5052 (50% of 1.5551/1.4565) before once again falling back into the consolidation area and finishing at 1.4960.With the Election approaching (7 May), and the result being anyone’s guess, it looks as […]

Forex Trading Opportunities for the Week Ahead 19 March 2015 by Sam Eder

I plan my trading for the week ahead each weekend. Here are the Forex trading opportunities I will be stalking this week. Note that this is my current view, but if market conditions change my view can change too. Generally I will trade in alignment with what I have noted here, though I will wait for […]

US$ & global stocks jittery by Mary McNamara

Last week: US$ weakness appeared last week and this enabled one new TC signal: A/U = up to 150 (open). This week: The US$ weakened last week and fell below some key support levels BUT I am still waiting for a decisive breakout move either above 100 or below 95.5. An update on the FX […]

Stock Index and Commodity Weekly Market Type Analysis 19/04/2015 by Sam Eder

Each week I review the current market type and fundamental considerations on a variety of stock and commodity indices. Market type analysis is critical to trade planning. MT = Market Type ( See lesson 8 in the Share Investing Course for Smart People) US Dow Jones – MT is sideways normal. Stay clear for […]

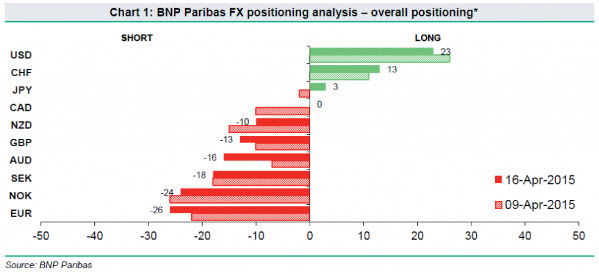

BNP Paribas FX Positioning Update

Our positioning analysis indicates that two core trades continue to be held by the market: long the USD and short the EUR. The EUR is now the largest short position. JPY positioning has increased to a small long, reaching its highest score since September 2012. Short positioning in the AUD continues to increase, while investors […]

London Open – FX Flows Update

Momentum funds pushed USD/CAD lower to 1.2180, but buying from macro funds then led to a bounce AUD/USD offers reported at 0.7820-30, while corporate bids seen at 0.7750. Talk of macro bids 0.7720 USD/JPY – Japs bids 118.80-90 region, stops thru 118.75. Offers 119.50 The post London Open – FX Flows Update appeared first on […]

US$ slide continues but support is nearby by Mary McNamara

Further weak US economic data has helped the US$ slide to continue. However, price is now resting at support and the next few sessions may help to determine whether this is just part of a corrective move higher OR a more decent pull back. This US$ weakness has helped risk currencies and Oil to make gains […]

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].