-

Euro, core bonds edge up ahead of ECB policy meeting

-

Treasuries decline, dollar steady; oil falls on inventories

An equities rout that wiped out the year’s gains in U.S. stocks took a breather in Europe even as Asia gauges extended declines. Treasuries fell and the dollar held steady.

Sentiment has been tested in October, with global stocks poised for their worst month in more than six years as the effects of trade tensions, geopolitics and rising Federal Reserve interest rates begin to bite. Investors remain apprehensive as a flood of earnings, while mostly stellar, have come with warnings about the future impact of tariffs and rising costs.

“The fear is palpable in stock markets at the moment,” Greg McKenna, a markets strategist at McKenna Macro, wrote in a note Thursday. “When folks are struggling to explain the driver of a move that means an obvious circuit breaker is also not in evidence. So this could get much worse before it gets better. Collapses happen after falls. That’s the danger.”

Elsewhere, the pound climbed with Brexit negotiations in the balance, and oil fell as American crude inventories continued to rise. Emerging market currencies and stocks slid.

Terminal readers can read more in our Markets Live blog.

Here are some key events coming up this week:

- ECB policy makers could on Thursday confirm that asset purchases will end this year, reiterating its pledge to keep interest rates at record lows through summer 2019. President Mario Draghi will hold a press conference.

- U.S. gross domestic product growth may have slowed in the third quarter, yet remained near its best pace since mid-2015, according to forecasts ahead of Friday’s release.

These are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index decreased 0.2 percent as of 9:20 a.m. London time, hitting the lowest in almost 23 months with its seventh consecutive decline.

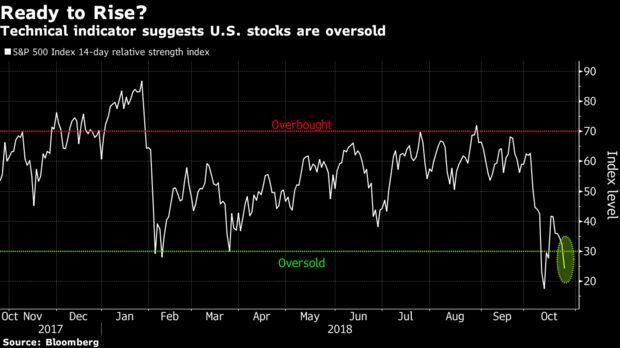

- Futures on the S&P 500 Index gained 0.6 percent, the first advance in more than a week.

- The MSCI All-Country World Index dipped 0.5 percent, hitting the lowest in 14 months with its seventh consecutive decline.

- The MSCI Emerging Market Index fell 1.1 percent to the lowest in more than 19 months.

Currencies

- The Bloomberg Dollar Spot Index decreased less than 0.05 percent.

- The euro gained 0.1 percent to $1.1403.

- The Japanese yen dipped less than 0.05 percent to 112.30 per dollar.

- The British pound advanced 0.1 percent to $1.2896.

- The MSCI Emerging Markets Currency Index sank 0.3 percent to 1,589.63 per euro, the lowest in two weeks.

Bonds

- The yield on 10-year Treasuries gained one basis point to 3.12 percent.

- Germany’s 10-year yield decreased one basis point to 0.39 percent, the lowest in almost seven weeks.

- Britain’s 10-year yield dipped one basis point to 1.446 percent, the lowest in seven weeks.

- The spread of Italy’s 10-year bonds over Germany’s fell two basis points to 3.1851 percentage points.

Commodities

- The Bloomberg Commodity Index declined 0.1 percent to the lowest in almost five weeks.

- West Texas Intermediate crude fell 0.7 percent to $66.36 a barrel, the lowest in more than two months.

- LME copper dipped 0.1 percent to $6,171.00 per metric ton, the lowest in a week.

- Gold decreased 0.1 percent to $1,232.88 an ounce.

— With assistance by Vildana Hajric, Sarah Ponczek, Samuel Potter, and Andreea Papuc

October 25, 2018, 7:34 PM GMT+11

Source: Bloomberg