The Fed’s Beige Book is out this morning.

Today’s podcast

Overview: Tainted love for equities?

- US equities fall on earnings headwinds (S&P500 -0.7%); industrials and energy lead the decline, while Netflix disappoints at the close

- Fed pricing for July extends (now 34bps), markets though likely seeing a Fed Funds cut of 25bps and an IOER cut of 30bps

- Oil falls again (WTI -2.2% to $56.38) on higher than expected oil inventories; note rumours of anti-war Senator Rand Paul being appointed as Iran Envoy

- Yields have now fully retraced Thursday’s moves with US 10yr yields -5.7bps to 2.0451%

- GBP steadies after yesterday’s falls, but remains near the lowest levels since April 2017 at 1.24

- Coming up: AU Employment, JN Trade Balance, UK Retail Sales, Philly Fed and Fed’s Williams

Today it’s all about stocks with the S&P500 down -0.7% overnight, driven by weakness in industrials and energy. Reporting season has thrown up three surprises that could influence equities over the next couple of week: (1) Freight companies are reporting softer revenue outlooks – CSX a US freight company reported it hauled 4% less freight and is likely linked to slowing industrial activity in the US; (2) Banks while largely beating headline profits are warning on net interest margins – BofAML noted net interest margins had declined by 7bps to 2.44%, below the market estimate of 2.47%; and (3) Some tech companies are not meeting analysts’ lofty expectations with Netflix missing overnight on new subscriber numbers, blaming emerging competitors – note Netflix reported at the market close and the stock down by some 13%. With US stocks having outperformed the rest of the world since 2018 and valuations at lofty levels, stocks will continue to be under scrutiny (see chart below).

Yields have also moved sharply, reversing the bond sell-off seen on Thursday with US 10yr yields -5.6bps to 2.04%. While there is no single catalyst, weaker stocks overnight, lower oil prices (see below) and ongoing concerns about the US/CH trade spat are all supportive factors. Importantly these factors do not look like they will be abating anytime soon and further gains could be likely. European yields are also moving largely in sync with concerns of a hard-Brexit/election in the UK – 10yr Gilt yields were -6.2bps to 0.76, while high anticipation of further ECB easing will likely keep Bund yields firmly in the negative (German 10yr Bund yields -4.6bps to -0.29).

FX has only seen moderate moves overnight. The USD (DXY) fell -0.2%, with EUR +0.1% and USD/YEN -0.3%. The biggest mover was the NZD +0.4% to 0.6731 with no single fundamental reason for the move. My BNZ colleague Jason Wong notes the NZD is seasonally strong in July (8 of the past 10 July’s the NZD has risen) and the NZD remains below model estimates of fair value (models suggest 0.68-0.69). The AUD has been broadly steady -0.1% to 0.7011 ahead of today’s Employment numbers which the AUD will be very sensitive too (see Coming Up).

Fed pricing for a July rate cut remains high. Around 34bps are priced for July and 73 cuts are priced by the end of the year. There is an important caveat to note however with pricing in that the effective fed funds rate has crept higher in recent days and is currently at 2.41%. It is likely markets are not only anticipating a Fed Funds cut of 25bps, but also an IOER cut of 30bps – the end impact of this is that a July rate cut is probably more 116% priced (instead of 136%) and an IOER cut is fully priced.

Economic data was largely sparse overnight. The Fed’s Beige Book remained bland with “expectations of continued modest growth, despite widespread concerns about the possible negative impact of trade-related uncertainty”. US Housing starts fell slightly more than expected, down -0.9% against the -0.7% consensus. Building permits though were down a sharper -6.1% against a +0.1% expected, though the data can be volatile on a monthly basis.

UK data continues to be ignored as Brexit emerges as a larger factor. UK CPI was largely in line with market expectations with headline at 2.0% and core at 1.8%. GBP held onto recent losses, remaining at its lowest levels since April 2017 at 1.24.

Coming up

Australian employment/unemployment data today at 11.30am will dominate markets – the consensus is looking for an unchanged unemployment rate at 5.2% and for 9k jobs. While NAB’s forecast is a little stronger at +20k, were the unemployment rate to tick higher it would be very significant and bring forward market pricing for an August rate cut. Note markets currently price in a 20% chance of an August rate cut, while a cut by the end of the year is almost fully priced. It is also worth noting here that CPI is also out on the 31 July and together with Employment will be a major input into the RBA’s outlook for rates. NAB continues to expect the RBA to cut rates in November, but with the risk that it is brought forward should unemployment and inflation disappoint.

For the rest of APAC, the Japanese Trade Balance will be watched closely given yesterday Singapore recorded non-oil re-exports fell for the first time since March 2013 (biggest fall in six years), suggesting global trade flows are continuing to slow in the face of US-China tensions and shifts in supply chains. For the Japanese Trade Balance markets look for a ¥403.5b surplus, up from last month’s deficit of ¥967bn

Europe has a fairly quiet session ahead with only UK Retail Sales (Ex Auto expected to be -0.2% m/m, similar pace to last month’s -0.3% as Brexit drags).

The US also has fairly quiet session ahead with only the Philly Fed and Jobless Claims of note. There are also a few Fed speakers, but this is unlikely to shift market expectations – the Fed’s Bostic and Williams (voter) are speaking with Williams giving the key note address on monetary policy at the annual Central Bank Research Association in NY with Q&A.

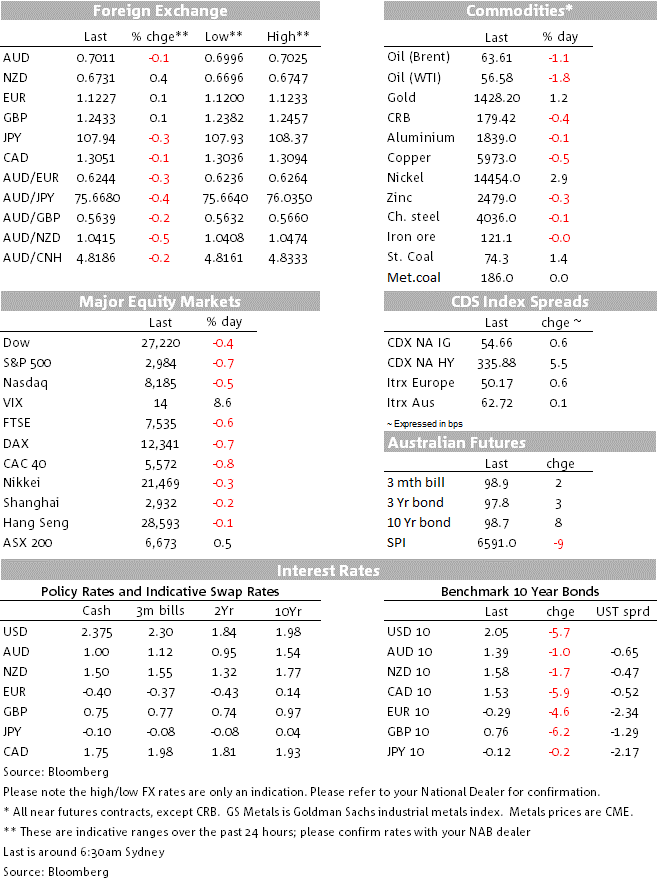

Market prices

18 Jul 2019

Source: NAB

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets