The latest IFO readings have shown a sharp downturn.

Today’s podcast

Overview: Never let me down again

- ECB stands pat, but lays the ground for a new round of stimulus in September

- Lack of details from Draghi disappoints markets pushing core yields higher

- US equities retreat from fresh highs amid underwhelming US earnings reports

- Solid US data keep the US as the least dirty shirt in the laundry

- USD stays strong – AUD and NZD softer amid risk off environment and dovish RBA

- USD Q2 GDP the data today’s data highlight

I’m taking a ride with my best friend, I hope he never lets me down – Depeche Mode

US and European equity markets ended the day lower and core global yields pushed higher amid a lack of stimulatory action from the ECB alongside a string of disappointing earnings reports. ECB president Draghi expressed concern over the outlook for the European economy, signalling stimulatory measures should be expected in September but he failed to provide any details. Overnight US data printed better than expected supporting the USD with the NZD and AUD underperforming in light of the risk off environment and yesterday’s dovish RBA message.

The ECB left its policy setting unchanged in line with consensus expectations, although there was a significant minority that was expecting a 10bps reduction in the deposit rate to -0.5%. Ahead of the meeting the market was pricing a 39% chance for a 10bps deposit cut. The ECB statement reemphasised the Banks commitment to prop up inflation with the Bank forward guidance expressing a commitment to keep its key interest rate at minus 0.4% or lower through the first half of 2020. The addition of the words “or lower” providing a clear signal that it is planning a rate cut in September. The statement also said that the Bank’s staff would examine “potential new net asset purchases” in an effort to push up persistently low inflation.

At the press conference ECB President Draghi noted that the economic outlook “is getting worse and worse,” especially in manufacturing and on inflation the president said “Basically we don’t like what we see.”. The Governing Council has been tasked to assess what tools or mix of tools could be used. So now it seems clear that come September we are going to get a mix of stimulatory measures rather than just one.When press on the matter, Draghi fail to provide a lot of detail, he favours the addition of a “tiering system” to soften the impact of negative interest rates, but Bloomberg reports that a significant number of the Governing Council are unconvinced of the merits of that and instead favour changing the terms of the latest long-term loan programme. One also has to add that there are some question marks on the ability and legality of restarting the asset purchasing programme, currently the Bank as a self-imposed rules limiting purchases up to 33% of any individual government’s debt and there is a German court challenging the legality of QE.

The lack of detail alongside a lack of urgency notwithstanding an explicit acknowledgement of things getting worse looks to have disappointed the market. Draghi has signalled a new Bazooka is being loaded for September, but after years of QE the surprise factor has lost its potency with many also questioning its effectiveness, including members within the ECB itself. It remains to be seen if stimulatory measures will do the trick in September, but based on today’s reaction something new and different is needed, more of the same is unlikely to do the trick. After some volatility around the announcement and Draghi’s press conference, the euro now trades at 1.1147, 15bps higher relative to pre ECB levels and 10y Bunds closed at-0.36%, 2bps higher. The money market now prices an 86% chance of a 10bps cut to the ECB’s deposit rate in September, taking it down to minus 0.50% with rate expected to reach -0.60% by July next year.

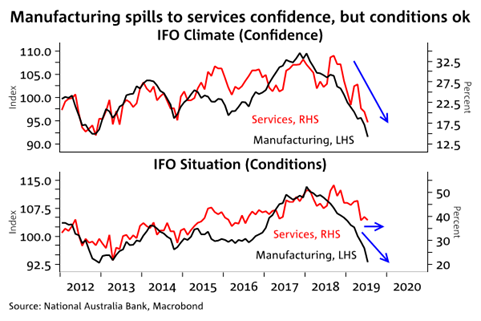

Earlier in the European session, the German IFO survey revealed both Business Confidence (AT 95.7; EST. 97.2) and Current Assessment (99.4; EST. 100.4) deteriorated in July and details in the report showed weakness in the manufacturing sentiment is now spilling over the to the larger services side of the economy, although conditions remain resilient. The survey write up also noted that “companies were less satisfied with their current business situation and are also looking ahead with increased scepticism. The German economy is navigating troubled waters.”

Looking at currencies in more detail, after pausing for breath yesterday, the USD has edged a little higher again with the DXY index now trading at 97.80. Durable goods orders data in the US were stronger than expected, including a lift for the core measure, going against the grain of weaker business confidence surveys and other activity indicators. While this was pleasing to see, advanced estimates on trade and inventories suggested that these components will act as a bigger-than-expected drag on Q2 GDP which is released tonight, placing downside risk to the consensus annualised 1.8% estimate – already on track for the weakest quarterly growth in over two years. US Treasury yields are up about 3bps across the curve, seeing the 10-year rate at 2.07%, pushing higher after the durable goods data were released.

The AUD now trades at 0.6951, 1bps above a key support level and 0.43% lower to levels this time yesterday. A dovish speech by RBA Governor lower yesterday didn’t help the aussie while the overnight risk off environment with US and European equities trading in the red didn’t help either with Tesla stealing some headlines after falling 15% on the back of a disappointing Q2 report while Southwest and American Airlines both dipped on more bad news resulting from Boeing’s Max grounding. Yesterday Governor Lowe said that “…if demand growth is not sufficient, the board is prepared to provide additional support by easing monetary policy further” and that “it is reasonable to expect an extended period of low interest rates”. Furthermore, “it is highly unlikely that we will be contemplating higher interest rates until we are confident that inflation will return to around the mid-point of the target”. The market moved to price in more easing – with now almost another full 25bps cut priced by October and two cuts by mid-next year – while the 10-year government rate fell by 7bps to a record low of 1.23%.

Alongside a weaker AUD and lower rates, the NZD weakened, heading down from around 0.6700 to around 0.6660, slightly underperforming the soft AUD. When the USD was losing ground early in July, NZD was one of the outperformers now that USD fortunes have reversed, the NZD is one of the big underperforms.

GBP is on the soft side as well, falling 0.3% to 1.2450. That said, GBP is holding up remarkably well considering the increased uncertainty about the outlook with new PM Johnson. In his first address to Parliament, Boris Johnson talked a tough game, saying that the terms of the current EU Withdrawal Agreement were unacceptable and he demanded the complete removal of the so-called Irish backstop as the key objective in future Brexit negotiations with the EU. With this having about zero chance of the EU accepting such a demand (and was immediately rejected by EU Chief Negotiator Barnier), the risk has increased of no agreement before the deadline of 31 October. This follows Johnson’s earlier comments on the steps of 10 Downing Street of “no ifs or buts” Britain would leave the EU in 99 days’ time and loading up his new Cabinet with hardline Brexiteers. Parliament is expected to push back on any hard Brexit so it seems that the scene is being set for a delay to Brexit to pave the way for an early general election.

German IFO – Free falling

Coming up

- JN Tokyo CPI July (core ex fresh food 0.8%yoy exp. vs 0.9% prev.)

- US GDP and Core PCE Q2

The market is looking for an annualized growth of 1.8%, which would be the lowest quarterly increase since 2016 and quite a big drop from the 3.1% print in Q1. Details in the report are also going to be important with some payback expected from inventories, after its solid contribution in Q1, while expectations are for an acceleration in consumer spending as well as a pick-up in residential investment. The latter will be welcome news for the Fed, overall however a Q2 GDP outcome in line with expectations should keep the FOMC on track for a 25bps funds rate cut next week.

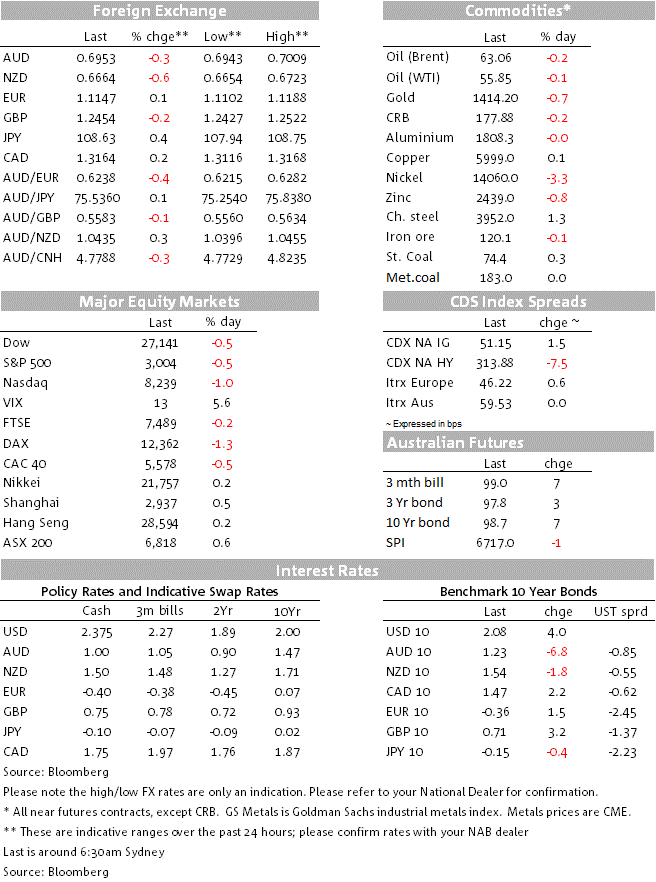

Market prices

26 Jul 2019

Source: NAB

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets