Boris Johnson stood outside No. 10 Downing Street earlier, saying he didn’t want an election before the Brexit deadline.

Today’s podcast

Overview: Sweet dreams (are made of this)

- UK General Election closer with Cabinet set to call one should Parliament vote to delay Brexit

- GBP -0.7% to 1.2067; GBP at risk should an election be announced

- Quiet otherwise with US Markets closed for the Labor Day Holiday

- US-China no closer to easing tensions, can’t even agree to a meeting date

- Aussie Q2 GDP looking soft after inventories; further partials today

- Coming up today: AU GDP Partials and Retail Sales, RBA (hold, but very dovish), UK Parliament resumes, US ISM Manufacturing

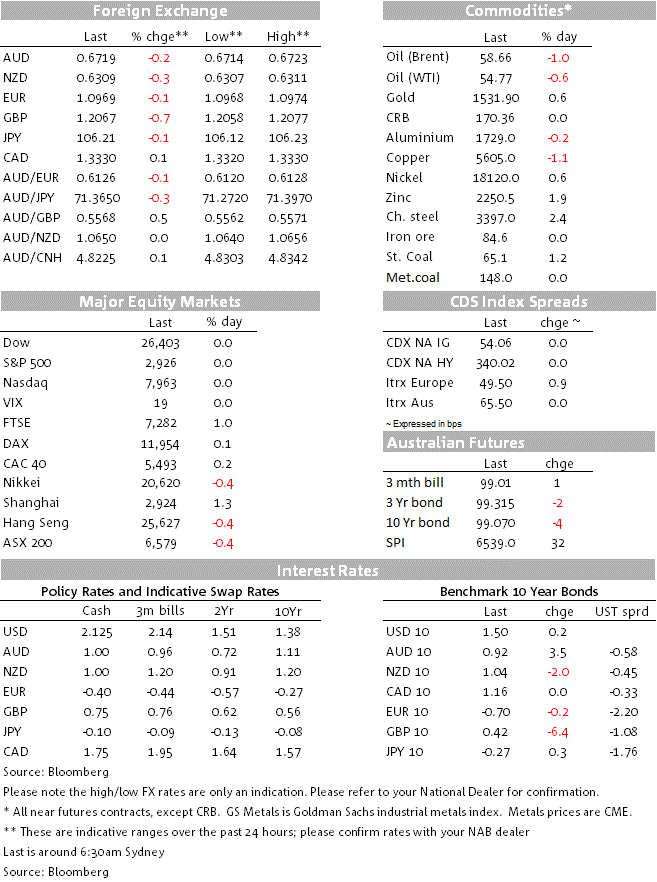

The Eurythmics “Sweet Dreams (Are Made of This)” was a 1983 classic, just missing out on the UK number one spot by Bonnie Tyler’s “Total Eclipse of the Heart”. So it was with the overnight session with the US Labor Day Public Holiday set to keep markets relatively quiet until reports emerged that UK PM Johnson is edging closer to a General Election. Sky News/ITV report that should the UK Parliament pass a bill to extend the Brexit deadline today (Article 50), then PM Johnson will table a motion for a General Election to be held on October 14. GBP has fallen some -0.7% to 1.2067 on the news, while 10yr Gilt yields are -6.4bps to 0.42%. Outside of the UK, markets were relatively quiet with US rate futures implying little change to Friday’s levels, while the USD (DXY) climbed 0.2% to 99.04 largely driven by GBP weakness (with EUR -0.1% to 1.0969 and USD/YEN -0.1% to 106.21). European equities were little changed outside of the UK (FTSE +0.1% on a lower GBP), while US equity futures are pointing to a -0.9% open.

First to Brexit news. The UK Parliament resumes today where a bill is set to be discussed that would compel the PM to seek a 3m Brexit extension to 31 January 2020 unless MPs had approved a deal or voted in favour of a no-deal departure by 19 October. PM Johnson in reaction has said “there are no circumstances [under] which I will ask Brussels to delay” and argued it would weaken the UK’s negotiating position.

A Cabinet meeting overnight discussed the possibility of holding an early General Election with ITV/Sky News both reporting that UK Ministers agreed that there would be a vote on Wednesday on whether to hold a general election on October 14 should Parliament pass a bill to extend the Brexit deadline. The election threat is centred straight at Tory MPs who may vote with opposition parties to try and extend the Brexit deadline. Note the 2011 Fixed-Term Parliament Act requires two-thirds of sitting MPs to agree to an election – though this is not likely to be a limit given the opposition Labour party has long argued for a general election. The scene is thus set for a tumultuous few days that is likely to see GBP come under further pressure. My colleague Gavin Friend has written a more detailed note on the threat of a general election and implications for GBP – email [email protected] if you would like a copy.

Compounding weakness in GBP was a soft UK Manufacturing PMI which came in at 47.4 against 48.4 expected, and is at its lowest level since July 2012. There were reports of some EU-based clients re-routing supply chains away from the UK, while the report itself feeds into fears that the UK may be heading towards a recession with Brexit stockpiling not appearing to be as large as it was in the lead into March.

US-China still remain no closer to easing tensions with a date for negotiators to meet in September yet to be determined. With the 70th anniversary of the founding the People’s Republic of China on October 1, we do not expect much progress on trade in the near-term as China’s focus increasingly turns towards the anniversary celebrations and then to the Party’s Fourth Plenum scheduled also for October.

CNH remains under pressure with USD/CNH +0.5% to 7.1928 overnight. News around Hong Kong continues to weigh. A better than expected Caixin Manufacturing PMI (50.4 v 49.8e) did little to reassure on the growth front with new orders remaining weak and export orders falling to its lowest level since November 2018. Commentary in the report noted “overall demand didn’t improve, and foreign demand declined notably, leading [to] product inventories to grow”.

There were also a number of other Manufacturing PMIs released overnight including the German PMI which came in at 43.5 against 43.6 expected. Overall there appears to be no letup in the global manufacturing slowdown and focus is now turning on whether the slowdown in the manufacturing side of the economy will weigh on the larger services side. Recent surveys including the German IFO and Official Chinese PMIs suggests it may be starting to.

Closer to home the AUD (-0.2%) and NZD (-0.3%) are both weaker with AUD fetching 0.6717 this morning. There was little reaction to yesterday’s GDP-partials of Inventories and Profits which suggested downside risks to Wednesday’s Q2 GDP. Inventories fell sharply and are set to detract around 0.6% points off quarterly GDP growth. Going into the release we thought inventories were going to add 0.1% points, so inventories presents sizeable downside risks to the market consensus for GDP of 0.5% q/q. More will be revealed today with Net Exports and Government Spending figures (see Coming Up Today below). The political smoke signals also highlight the risk of a weak Q2 GDP figure with PM Morrison yesterday stating he was “expecting soft June quarter results on Wednesday” and was urging people to “look through” the June numbers to the September quarter which will incorporate the effects of the income tax cuts which came into effect on July 1 as well as recent RBA rate cuts.

Coming up today

A very busy day today with key pre-GDP partials ahead of Q2 GDP on Wednesday, along with Retail Sales and the RBA. International focus will be on the UK Parliament which resumes from its break and on the US Manufacturing ISM:

- AU: GDP Partials (11.30am AEST): Net Exports and Government Spending for Q2 are out this morning and will help hone analysts’ forecasts for Q2 GDP on Wednesday. Consensus for Net Exports look for a 0.3% point contribution – NAB a little stronger at 0.4%, and while there is no consensus for Government Spending NAB looks for a 0.3% point contribution. Both of these contributions will be needed (and more) with inventories yesterday pointing to substantial downside risks to Q2 GDP on Wednesday. As a possible herald to a soft GDP number, PM Morrison yesterday warned the quarter would be “soft”. More optimistic news though could come from the Balance of Payments with Australia set to record its first current account surplus since the 1970s.

- AU: Retail Sales (11.30am AEST): July Retail Sales will have greater than usual focus with policy markers looking to see whether recent income tax cuts and interest rate cuts are stimulating consumption. NAB’s Cashless Retail Index suggests not, with our indicator suggesting Retail Sales rose by just +0.1% m/m. Markets also do not expect to see much of a boost with consensus at +0.2% m/m.

- AU: RBA Meeting (2.30pm AEST): The RBA is expected to be on hold with 30/34 economists tipping an unchanged decision at 2.30pm and markets only pricing a 12% chance of a rate cut. The RBA indicated in August that it was in assessment mode and would wait until an “accumulation of additional evidence”. Recent data suggests the economy remains soft with little sign of retail picking up on the back of tax cuts, though we expect the RBA to wait until next month’s data before deciding in case spending was shifted between quarters. We expect the post-meeting Statement to read dovishly and could more explicitly signal a rate cut at an upcoming meeting given softness in GDP partials, a sharper decline in housing construction than forecast, and little sign that households choose to spend their recent tax cut. Markets currently price a 73% chance of an October rate cut.

- EZ: PPI (11.00am local, 7.00pm AEST):

- UK: Parliament Resumes: Parliament resumes today where all focus will be on whether MPs table and pass a bill to extend the Brexit deadline (default Brexit date is 31 October, proposal is to extend for 3m if a deal cannot be agreed by Parliament). Papers report PM Johnson is threatening de‑selection of conservative MPs who vote to block a no-deal Brexit, while a General Election is looking increasingly likely with Sky News/ITV reporting Ministers had signed off on a vote on Wednesday on whether to hold a general election should a bill to extend the Brexit deadline by passed.

- UK: Construction PMI (9.30am local, 6.30pm AEST:

- US: ISM Manufacturing (10.00am local, 0.00am AEST): Consensus looks for an unchanged print of 51.2, below its long-run average of 52.9. The risks around the survey appear to be balanced with regional indexes pointing to a slightly stronger print, but the latest escalation in tariffs late in the month have the potential to weigh on the survey with responses not generally submitted until late in the month.

- US: Construction Spending (10.00am local, 0.00am AEST): Construction spending doesn’t tend to move markets, consensus looks for a +0.3% m/m print in July, up from -1.3% previously.

- US: Fed’s Rosengren (5.00pm local, 7.00am AEST): Rosengren (voter, hawkish) is speaking with text and Q&A. Rosengren last spoke in late August and stated he wanted evidence of a slowdown to justify a September rate cut – “I’m not saying there are not circumstances in which I’d be willing to ease. I just want to see evidence we are going into something that is more a slowdown.’’. It is unlikely his attitude has changed, but importantly the balance of the FOMC appear to be backing another insurance rate cut at the September and markets price 2.4 rate cuts by the end of the year.

- CA: Manufacturing PMI (10.00am local, 0.00am AEST):

Market prices

3 Sep 2019

Source: NAB

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets