-

U.S. equity futures tumble as shares decline in Europe, Asia

-

10-Year Treasury yield drops to late-March level; yen climbs

U.S. equity futures slumped with Asian shares while European equities edged lower as investors awaited details on the countermeasures China warned it would impose following last week’s escalation in the trade war between the world’s top two economies. The yuan tumbled and Treasuries rallied.

Contracts on the S&P 500, Dow Jones Industrial Average and Nasdaq 100 indexes all slid, pointing to a big drop at the U.S. open. In Europe, the Stoxx Europe 600 index was dragged into the red by automakers. With no date scheduled for a resumption in bilateral Sino-U.S. talks, shares dropped across Asia, with the sharpest declines in Taipei and Seoul. Hong Kong was closed for a holiday. Haven assets advanced, with 10-year Treasury yields falling to the lowest level since late March. The yen strengthened while commodities slipped.

Investors are struggling to find positive catalysts for risk assets after the U.S. increased levies on about $200 billion worth of Chinese goods and Beijing was thought to be preparing a retaliation. While both economic superpowers have worked hard since talks ended Friday to project calm and emphasize that they plan to continue negotiations, markets seem unable to shake off the current gloomy mood.

“Central banks this year have switched into this dovish pivot — that’s allowed the market to continue higher whatever the weather” until recently, said Eleanor Creagh, Sydney-based Australia market strategist at Saxo Capital Markets, on Bloomberg Television. “With the breakdown of these trade negotiations people will have to sit back and think how far this dovish central bank stance can really continue to carry us.”

Chinese state media blamed the U.S. for a lack of progress in trade talks while emphasizing China’s economic resilience.

Elsewhere, Bitcoin climbed above $7,000 as the recent gains in cryptocurrencies extended over the weekend. Base metals retreated as traders reassessed the demand outlook give the threats to global economic growth. Other commodities were also caught in the crossfire of the trade impasse, with China’s cotton futures plunging by the daily limit.

Here are some notable events coming up this week:

- Earnings this week include Vodafone, Alibaba, Tencent, Cisco, Nvidia.

- A slew of Federal Reserve policy makers speak: Boston Fed President Eric Rosengren and Fed Vice Chairman Richard Clarida speak at a “Fed Listens” event hosted by the Boston Fed. New York Fed President John Williams speaks at an event in Zurich. Kansas City Fed President Esther George and Richmond Fed President Thomas Barkin also make appearances.

- Japan balance of payments is due Tuesday.

- China industrial production and retail sales are slated for Wednesday, same day as U.S. retail sales and industrial production.

- Bank of Indonesia has an interest rate decision on Thursday.

- Australian unemployment is out on Thursday.

These are the main moves in markets:

Stocks

- Futures on the S&P 500 Index slumped 1.2% as of 8:12 a.m. London time.

- The Stoxx Europe 600 Index slipped 0.2%.

- The MSCI Asia Pacific Index fell 0.7%.

- The MSCI Emerging Market Index dropped 0.6%.

Currencies

- The Bloomberg Dollar Spot Index advanced 0.2%.

- The offshore yuan fell 0.8% to 6.8985 per dollar and the biggest drop in more than nine months.

- The euro climbed less than 0.05% to $1.1234, the strongest in three weeks.

Bonds

- The yield on 10-year Treasuries declined four basis points to 2.43%.

- Germany’s 10-year yield fell one basis point to -0.05%.

Commodities

- The Bloomberg Commodity Index dropped 0.3% to 78.46.

- LME nickel fell 0.8% to $11,830 per metric ton.

- West Texas Intermediate crude rose 0.3% to $61.86 a barrel.

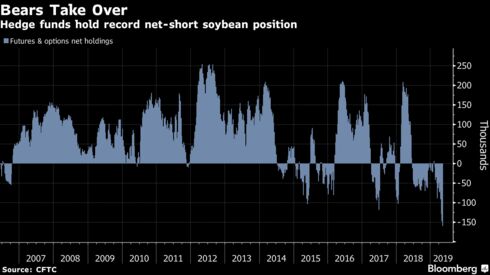

- Soybeans slulmped 0.9% to $8.02 a bushel.

By Andreea Papuc and Todd White

— With assistance by Netty Idayu Ismail, Abeer Abu Omar, and Adam Haigh

13 May 2019, 17:26 GMT+10

Source: Bloomberg