-

Euro pares earlier gains from Merkel coalition breakthrough

-

Treasuries edge higher after recent selloff; oil rises

Asian equities traded mixed, while the dollar and Treasuries halted a recent selloff as investors assessed the impact of the U.S. federal government shutdown.

The greenback was steady as the shutdown dragged into a third day after Senate leaders failed to end the impasse. The euro pared an earlier advance spurred by optimism Germany’s Angela Merkel has made a breakthrough toward her fourth term after months of stalemate. Foreign exchange traders continue to watch China’s appetite for currency strength as the yuan trades at the symbolically key level of 6.4 per dollar. Equities in South Korea and Australia retreated, with other major bourses edging higher.

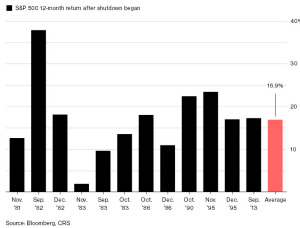

Equity markets have largely shrugged off America’s government shutdown drama as bets on broadening global economic growth and expanding profits pushed stocks to all-time highs this month. Commentary from policy makers after central bank decisions in Europe and Japan this week may provide the next catalyst after a surge in government bond yields that’s been prompted by signals that unprecedented stimulus will soon be wound back.

“Due to the limited economic impact, markets should be largely unaffected,” by the government shutdown, said Poul Kristensen, portfolio manager at New York Life Investment Management. “If there is a little pullback, we believe it will be a buying opportunity. The last time the government shut down in 2013, markets moved higher.”

Elsewhere, Brent oil halted its decline from the highest level in more than three years as OPEC and Russia said output cuts will continue until the end of the year and signaled a readiness to coordinate beyond that.

Terminal users can read more in our markets blog.

Here’s what to watch out for this week:

- Barring any last minute dramatics in Washington, President Donald Trump will join world leaders and senior executives in Davos, Switzerland, for the annual World Economic Forum.

- Central banks: Bank of Japan monetary policy decision and briefing on Tuesday; European Central Bank rate decision on Thursday

- U.K. Prime Minister Theresa May’s Brexit bill is set to be taken up in the House of Lords.

- Earnings season is in full swing: Netflix, UBS Group, Halliburton, Novartis, General Electric, Intel, LVMH Moet Hennessy Louis Vuitton, Starbucks, Hyundai Motor andFanuc Corp. are among companies posting results.

And these are the main moves in markets:

Stocks

- Euro Stoxx 50 futures climbed 0.1 percent in early European trading. Futures on the S&P 500 Index dipped 0.1 percent.

- The MSCI Asia Pacific Index increased 0.1 percent as of 4:09 p.m. Tokyo time, the highest on record.

- Japan’s Topix index gained 0.1 percent.

- Hong Kong’s Hang Seng Index rose 0.5 percent, hitting the highest on record with its fifth straight advance.

- Australia’s S&P/ASX 200 Index sank 0.2 percent, hitting the lowest in more than six weeks with its fifth straight decline.

Currencies

- The Bloomberg Dollar Spot Index gained less than 0.05 percent.

- The Japanese yen fell 0.1 percent to 110.86 per dollar.

- The euro gained less than 0.05 percent to $1.2223.

Bonds

- The yield on 10-year Treasuries declined one basis point to 2.65 percent, the biggest drop in more than a week.

- German 10-year bund yields were little changed at 0.57 percent.

Commodities

- West Texas Intermediate crude gained 0.3 percent to $63.55 a barrel.

- Gold dipped 0.1 percent to $1,329.97 an ounce.

- LME copper advanced 0.8 percent to $7,096.50 per metric ton, the highest in a week on the biggest gain in a week.

By Adam Haigh

Source: Bloomberg